Gardens are getting Bigger!

The demand for gardens and other private outdoor spaces has grown since the pandemic, when we all re-learned their value – whether as a refuge to relax in or an opportunity to extend our homes with garden offices and outdoor entertaining areas.

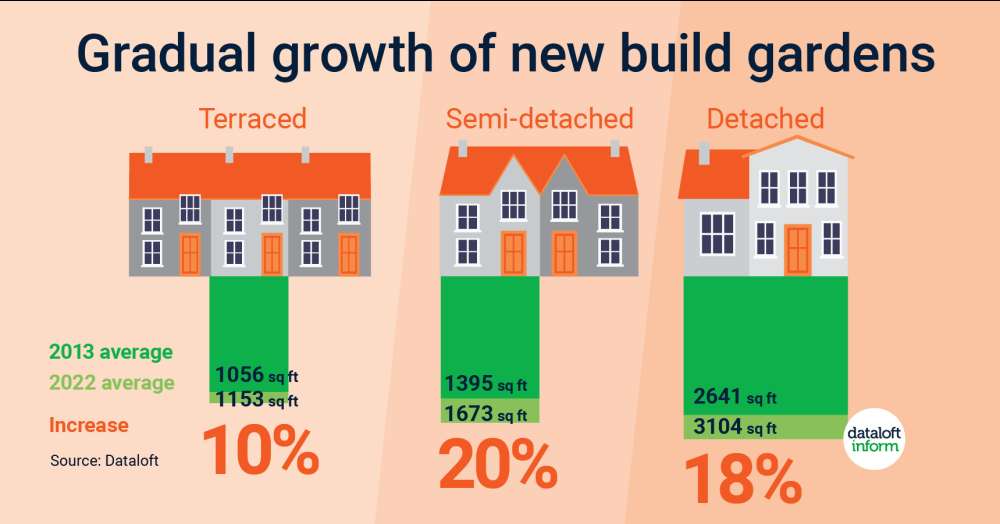

- There is a popular belief that new build homes come with tiny gardens but the evidence suggests that since 2020, homebuilders have been gradually expanding the size of gardens.

- Compared to 10 years ago, gardens of new build detached homes are 18% larger today. For semi-detached homes they have grown by 20% and in terraced houses, by 10%.

- The number of searches on Google for 'garden rooms' has risen by 27% since 2019 and for 'house for sale garden' by 47%. Housebuilders, it seems, have tuned in to the zeitgeist. Source: #Dataloft 2023, Google Trends